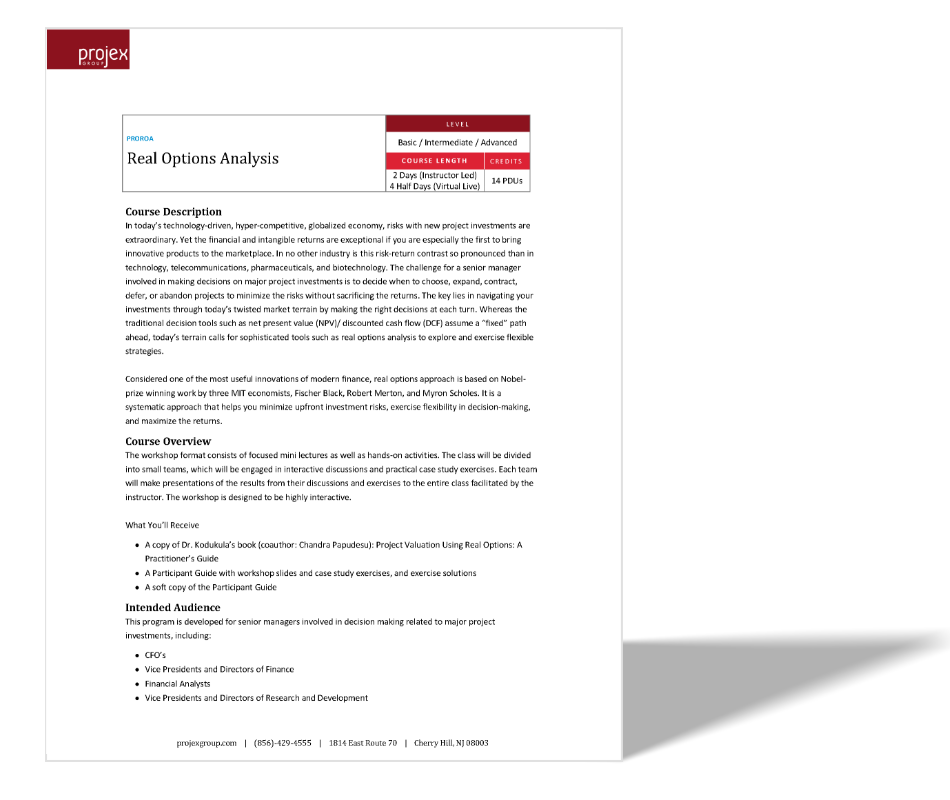

PROROA

Real Options Analysis

LEVEL

Basic / Intermediate / Advanced

COURSE LENGTH

2 Days (Instructor Led)

4 Half Days (Virtual Live)

CREDITS

14 PDUs

Course Description

In today’s technology-driven, hyper-competitive, globalized economy, risks with new project investments are extraordinary. Yet the financial and intangible returns are exceptional if you are especially the first to bring innovative products to the marketplace. In no other industry is this risk-return contrast so pronounced than in technology, telecommunications, pharmaceuticals, and biotechnology. The challenge for a senior manager involved in making decisions on major project investments is to decide when to choose, expand, contract, defer, or abandon projects to minimize the risks without sacrificing the returns. The key lies in navigating your investments through today’s twisted market terrain by making the right decisions at each turn. Whereas the traditional decision tools such as net present value (NPV)/ discounted cash flow (DCF) assume a “fixed” path ahead, today’s terrain calls for sophisticated tools such as real options analysis to explore and exercise flexible strategies.

Considered one of the most useful innovations of modern finance, real options approach is based on Nobel-prize winning work by three MIT economists, Fischer Black, Robert Merton, and Myron Scholes. It is a systematic approach that helps you minimize upfront investment risks, exercise flexibility in decision-making, and maximize the returns.

Learning Objectives:

Why traditional valuation methods such as NPV/DCF are no longer effective in today’s uncertain world.

What are real options and how they are different from financial options.

Various simple and compound options that represent most common applications.

Why you must use real options to achieve strategic alignment of projects and sustainable competitive advantage.

How real options provide flexibility in decision making.

A simplified six-step process to apply real options approach to real world projects.

Valuation of real options that help you decide whether to hold back a new product for a year or introduce it this year.

Application of chooser, sequential, and abandon options in research and development to exercise maximum flexibility with decision making coupled with minimum investment losses.

Use of real options in making the right decisions at each juncture of “staged” projects (e.g., drug development, buying radio frequencies - building networks - offering services, etc. in telecommunications).

How to introduce real options approach as a standard technique in the project investment decision-making process in your organization.

Challenges and pitfalls as well as success stories related to real world application of real options.